Loan

Best Low & Bad Credit Score Loan App 2026

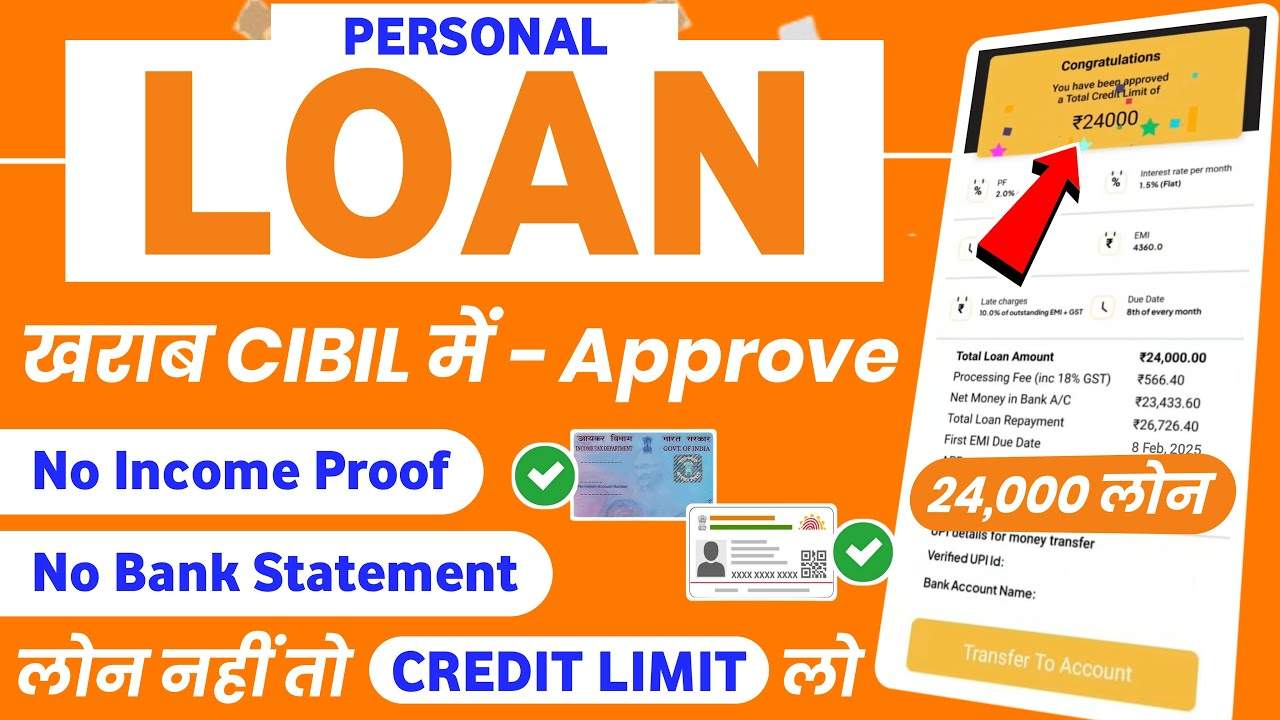

Having a low or bad credit score can make it challenging to secure a loan, but some apps cater specifically to such borrowers. These apps are designed to offer loans with flexible eligibility criteria and quick approvals, even if your credit score isn’t perfect. Here’s a guide to the best low and bad credit score loan apps in 2025.

Features of Low and Bad Credit Score Loan Apps

- Flexible Eligibility

These apps prioritize alternative financial data over traditional credit scores, making it easier for borrowers with low CIBIL scores to qualify. - Quick Approvals

Instant verification and digital processing enable loan approvals within minutes. - Small Loan Amounts

Ideal for emergencies, these apps often offer smaller loans ranging from ₹5,000 to ₹1,00,000. - Higher Interest Rates

Due to the higher risk associated with low-credit borrowers, interest rates may be slightly higher. - Repayment Tenures

Flexible repayment options, usually ranging from 3 to 24 months, are provided to suit borrower needs.

How to Apply for a Loan with Low Credit Score

- Download the App

Choose a reputed loan app that supports low-credit borrowers. - Register and Provide Details

- Complete the registration process with your mobile number.

- Submit identity proof, address proof, and income details.

- Select Loan Amount and Tenure

Choose the loan amount and repayment period based on your financial capability. - Submit Application

Upload required documents and wait for the app to process your application. - Receive Loan Amount

Upon approval, the amount is disbursed directly into your bank account.

Popular Loan Apps for Low Credit Scores in 2025

- MoneyTap: Offers loans up to ₹5,00,000 with minimal documentation.

- KreditBee: Specializes in small personal loans for those with low credit.

- Cashe: Provides loans based on social and professional profiles.

Benefits of Using Loan Apps for Bad Credit

- Easy access to funds without stringent eligibility criteria

- Fully digital application process

- Instant fund disbursal

- No need for collateral or guarantors

For more information on borrowing options, check out Low CIBIL Score Par Loan Kaise Le.

Conclusion

Low and bad credit score loan apps in 2025 provide a lifeline for those struggling with financial emergencies. By choosing the right app and managing repayments responsibly, you can improve your credit score while meeting your immediate needs. Always compare options to find the best app for your requirements.