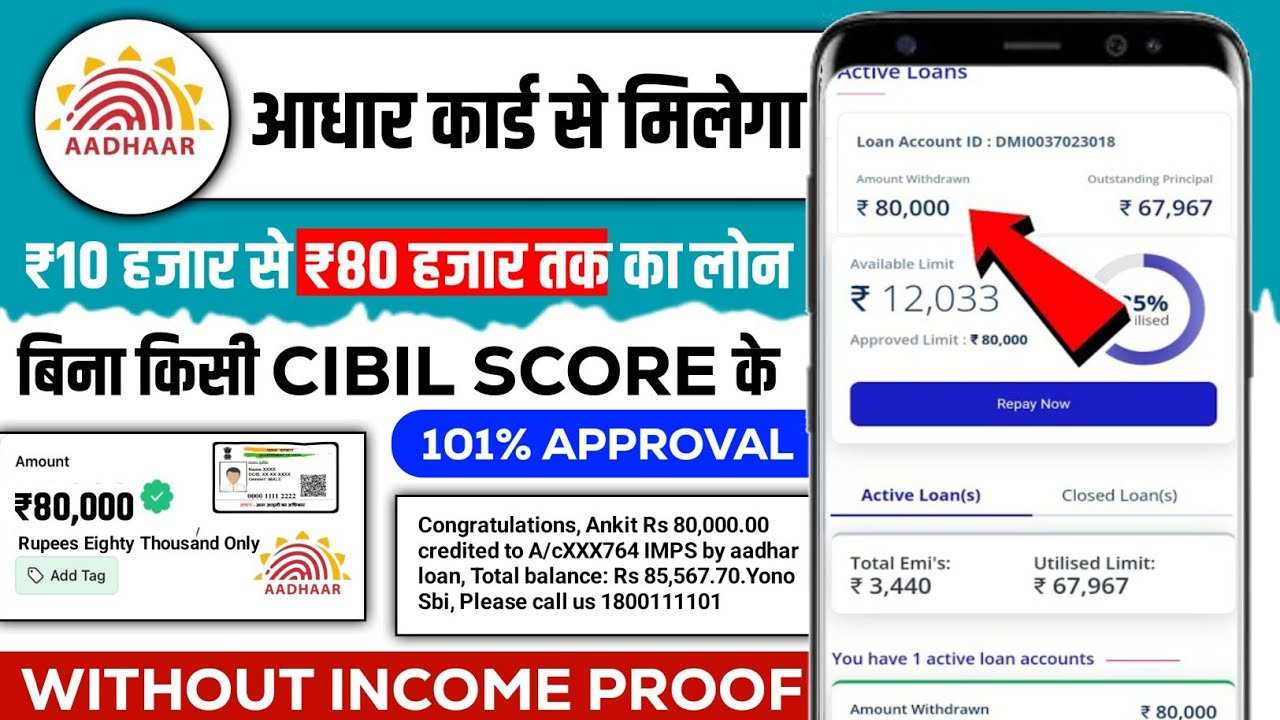

How to take loan from Aadhar Card? Aadhar Card Personal Loan | How to take loan from aadhar card 2025

Aadhar Card has become a key document for availing various financial services in India, including personal loans. It acts as a reliable form of identity and address proof, simplifying the loan application process. Here’s a complete guide on how to take a personal loan using your Aadhar Card.

How to Apply for a Personal Loan with Aadhar Card

- Choose a Lender

Research and select a financial institution or lender that accepts Aadhar Card as a primary KYC document. This includes banks, NBFCs, and digital lending platforms. - Check Eligibility

- You must be an Indian citizen.

- Your age should typically be between 21 and 60 years.

- A stable income source and a good credit score are usually required.

- Gather Necessary Documents

- Aadhar Card for identity and address proof

- PAN Card for income tax verification

- Income proof such as salary slips or bank statements

- Passport-sized photographs

- Submit an Online Application

- Visit the lender’s website or app.

- Fill in the application form with details like loan amount, tenure, and purpose.

- Upload your Aadhar Card and other required documents.

- Complete eKYC Verification

- Authenticate your identity using the Aadhar Card OTP-based verification process.

- This is a paperless and instant verification method.

- Loan Approval and Disbursal

- After document verification and credit evaluation, the lender approves the loan.

- The approved loan amount is credited directly to your bank account.

Benefits of Taking a Loan with Aadhar Card

- Paperless Process: Reduces the need for physical documentation.

- Quick Approval: eKYC speeds up the approval process.

- Widely Accepted: Most lenders in India accept Aadhar Card for personal loans.

- Secure Verification: The OTP-based authentication process ensures data security.

Why Choose Aadhar Card for Personal Loans in 2025

Aadhar Card is a universal identification document that simplifies the loan process, especially in 2025 when digital lending platforms dominate the market. Its integration with government databases ensures accurate verification, making it a reliable option for borrowers and lenders alike.

For additional loan options and detailed guidance, explore Phone Pe Business Loan Online Apply 2025.

Conclusion

Taking a loan with your Aadhar Card is fast, convenient, and widely accessible. Ensure that you meet the lender’s eligibility criteria and provide accurate information during the application process. Always compare loan offers from different lenders to secure the best terms for your financial needs.